The Difference Between an Amazon DSP and a FedEx CSP

Bottom-Line: While both Amazon DSPs and FedEx CSPs provide similar last mile delivery services, FedEx CSPs can more easily build equity in their businesses. Bank financing for prospective buyers of CSP is more readily available given 1) CSPs are SBA eligible (DSPs are not) 2) FedEx provides a straight forward process to allow contracts to transfer (Amazon doesn’t), 3) CSPs contracts provide exclusive territory (Amazon doesn’t) and 4) CSPs typically own trucks which helps provide collateral for banks (DSPs don’t).

If your goal is to only build out a cash flow machine, both the DSP and CSP option will work well for you. However, if your goal is to someday monetize and sell your delivery business, becoming a FedEx CSP is the better option.

Amazon and FedEx Relationship

The history of Amazon and FedEx’s relationship reads a bit like a soap opera. Prior to becoming competitors, they were collaborators.

From Amazon’s nascence, FedEx was a reliable and much relied upon partner. Their superior logistics capacity, in development since the company’s founding in 1971, had long placed them at the forefront of the delivery service industry. As such, Amazon depended on FedEx for their timely air and ground deliveries to enable their growth as a reputable online retailer.

However, the relationship began to sour in 2013, following a holiday season during which FedEx struggled to deliver the unexpectedly high volume of Amazon orders on time. Amazon began to build out its own delivery and logistics networks, lessening its dependence on FedEx’s services.

Finally, the big break-up occurred in 2019. In June, FedEx announced that it would not renew its air delivery contract with Amazon; and, in August, FedEx finalized the divorce by ending ground delivery of packages as well. Their decision hinged upon the expectation of continued growth in e-commerce as well as the deterioration of their relationship with Amazon.

In retaliation, Amazon forbade its third-party merchants from using FedEx in December of that year. They reversed the decision, though, in January 2020. This retraction proved fortunate, as “Shipageddon” lay just around the corner, precipitated by and continuing throughout the COVID-19 pandemic.

Although the acute delivery logistics crises of 2020 have largely abated, the rivalry between Amazon and FedEx remains with each competitor expanding and updating their capabilities to meet the needs of the future of e-commerce.

The good news is that both companies have opportunities to start or invest in package-handling businesses although the specifics involved are decidedly different. Small businesses affiliated with Amazon are known as Delivery Service Partners (DSPs), while businesses associated with FedEx are Contracted Service Providers (CSPs).

Amazon DSPs

Amazon DSPs are strictly package-delivery businesses, best suited for individuals with little to no experience running a business and limited access to startup capital. The DSP owner is akin to a middle manager in a large corporation and has little latitude or flexibility in decision-making; but, as a small business owner, an Amazon DSP owner assumes additional liability.

To apply for DSP ownership, an individual – partnerships are not allowed – is thoroughly interviewed and screened to ensure appropriateness of fit with Amazon. Although startup costs can run as low as $10,000, the candidate must have at least $30,000 in liquid assets to receive final approval. Investors and those wishing to run package-delivery businesses in multiple locations are not eligible for the DSP program. Candidates whose spouse or partner own a DSP are also disqualified. DSP candidates are not eligible for SBA loans because their contracts can be cancelled after 30 days.

Once selected, the candidate is assigned to a specific delivery station and receives two weeks of on-boarding training. The following image is an excerpt from Amazon’s DSP marketing brochure, detailing the training:

Source: Amazon Logistics[1]

It is fair to note that during week one Amazon introduces the deals with third-party vendors that it has arranged. Owner-operators are expected to take advantage of these deals without considering outside options. Though transacting with Amazon’s pre-approved third-party vendors simplifies the process of new business ownership, the DSP owner has few, if any, alternative choices to consider. Furthermore, an inexperienced owner may be more inclined to accept Amazon’s recommendations because they have no frame of reference by which to assess the quality of an accountant, lawyer, health plan, etc.

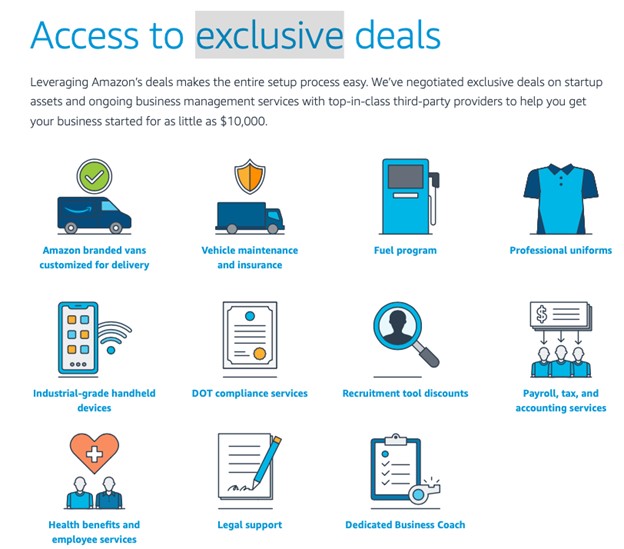

This image, again from the Amazon brochure, shows the arrangements Amazon has made with third-party vendors for its DSPs:

Source: Amazon Logistics[2]

After training is complete, the DSP owner finalizes startup by creating their business entity along with filing for all necessary licenses. Additional startup costs include obtaining professional services (e.g. accounting, legal, etc.), purchasing setup supplies such as a laptop and time-keeping software, recruiting and hiring, administering drug tests and background checks, and providing driver training.

The DSP owner must begin operations with at least five vehicles and is expected to expand operations to 20-40 vehicles. The Amazon branded vehicles must be leased and not owned. The DSP owner is responsible for all employee costs, including benefits, payroll taxes, and insurance; vehicle costs; asset costs such as devices and uniforms; administrative costs; and professional services costs. The graphic above shows that Amazon has already provided access to the business management services that will assist DSPs with the bookkeeping aspects of their business.

The daily routine of a DSP is primarily focused on the management of their delivery team. They schedule their drivers using Amazon scheduling tools, report daily to their designated delivery station to receive daily routes, delegate these routes to their drivers, and lead a daily morning huddle with their team. DSPs do not have an exclusive delivery service area, nor do they have control over route design or delivery sequence.

Throughout the day they track their drivers progress and respond to any delivery-related issues. Amazon’s support personnel are available for assistance as needed. Recruiting, hiring, and bookkeeping are continuing tasks along with coaching, helping, and motivating drivers. The day ends with a route debrief and ensuring that all vans are prepared to begin delivery the following day.

It is clear that DSPs are highly team focused and customer service oriented. They meet weekly with Amazon representatives from their delivery station as well as their Amazon Business Coach. At these check-ins, the Amazon representatives and Business Coach provide performance reviews and offer suggestions as to how the DSP can continue to improve and grow their business.

DSPs are paid monthly and must be mindful of their anticipated cash flow to remain solvent. This graphic shows how revenues are calculated.

Source: Amazon Logistics[3]

The revenue and profit projections for a DSP owner running 20 to 40 vans are as follows:

Source: Amazon Logistics[4]

These estimates are provided by Amazon Logistics, and it is not possible to verify their accuracy.

In summary, DSP ownership is an attractive option for the individual who is passionate about managing a team and focusing on customer service. Amazon provides for a quick, low-cost startup while taking a lot of the guesswork out of business management. As a trade-off, the DSP owner cedes a significant amount of decision-making to Amazon Logistics and accepts intensive oversight of their operations. Profit potential is also limited because they may only run up to 40 vans out of one delivery station and may not expand beyond that constraint. Perhaps the biggest negative of being a DSP is the difficulty of monetizing the asset to sell. Given the structure of the contract, it is extremely difficult to get 3rd party financing in order for a buyer to purchase. This is not the case with FedEx CSPs.

FedEx CSPs

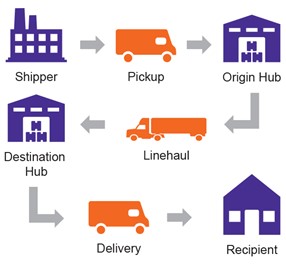

FedEx CSPs differ significantly from Amazon DSPs on almost all parameters and are an excellent opportunity for the more experienced business owner or investor with a greater capacity to finance the purchase of their business. FedEx CSPs may operate either a Pickup and Delivery (P&D) business or a Linehaul business where packages are transported between stations and hubs, or hubs and hubs. For the sake of comparison with DSPs, we shall focus on P&D businesses where direct customer interaction is involved. However, much of the same information is directly applicable to Linehaul businesses.

To become a FedEx CSP, a business must contract with FedEx to provide service for a contracted service area. Typically, the business will purchase the routes from an existing CSP and maximize the benefit of this transaction with the assistance of a qualified brokerage. The purchasing business must be established as a for profit corporation, excluding LLCs, LLPs, sole proprietorships, and the like. Investors who do not wish to be owner-operators, and would rather delegate daily decision making to a general manager, are not excluded from purchasing routes and contracting with FedEx as an CSP.

While CSPs may only contract for one service area per station/hub, they may contract for routes that service another hub. The operations of an CSP are succinctly captured in the following graphic; but, bear in mind that CSPs not only deliver packages to a hub for transport, but they also pick up packages for delivery to residences and businesses within their service area.

Source: FedEx Ground[5]

CSPs, having purchased routes and contracted with FedEx to provide P&D services, operate exclusively within their contracted service area. As independent businesses, they must purchase the assets (e.g. vans and trucks) and hire and train the employees necessary to meet the conditions of their contract. However, it is at the sole discretion of the CSP owner and/or general manager to determine type and number of equipment needed, personnel and staffing decisions, work area configuration, route design, pickup sequence, and delivery sequence.

As independent businesses, CSPs are also responsible for:

- Employer related expenses including but not limited to:

- Wages, salaries, and benefits

- Employment taxes and unemployment insurance

- Workers’ compensation and coverage

- Providing FedEx approved uniforms as necessary

- Payroll and accounting management such as:

- Payroll deductions

- Payroll and employment records

- Compliance with local, state, and labor laws including the U.S. Fair Labor Standards Act

- Hiring and training personnel and providing FedEx approved uniforms to personnel in contact with the public

- Vehicle related maintenance and insurance

- Maintaining registration and good standing in the state in which the business is incorporated

- Service reliability, especially with respect to timeliness

- Upholding the image of the FedEx Ground brand as the preeminent delivery service available

While the responsibilities of CSP owners are sundry, the modes and methods employed to fulfill these responsibilities are left to their own judgment. So long as they meet the conditions of their contract, CSPs are given full latitude to run their businesses to maximize productivity and profitability, which leads us to compensation.

CSPs are paid an agreed upon amount that factors in the volume of stops and the packages delivered as well as other terms addressed in the agreement with FedEx Ground. Payments are made on a weekly basis, providing reliable cash flow, and enabling constant planning and adjustment to changing circumstances.

Profits depend on the productivity and efficiency of the CSP. However, with the continual growth of e-commerce, opportunities for CSPs to expand their businesses and profits are essentially boundless. P&D service areas are becoming increasingly dense, including both business and residential postal codes. Increased customer demand and business results yield higher weekly revenues. CSPs may also avail themselves of optional seasonal incentives and third-party vendor discounts on vehicle maintenance, tires, etc. Finally, it is important to remember that an CSP may contract out of additional hubs so long as the hubs are distinct. Growth is only limited by the desire, capacity, and competence of the CSP to uphold their contracts with FedEx Ground.

Becoming a FedEx CSP is an outstanding opportunity for the investor and/or owner-operator that wishes to take on the full risks and rewards of business ownership. Exercising full decision-making power over the operations of one’s business requires knowledge, experience, and access to the resources that allow one to make optimal decisions pertaining to efficiency, growth, and profitability.

Although CSPs are independent, FedEx Ground does not take their contractors for granted. FedEx Ground recognizes its top service providers with several awards: Entrepreneur of the Year and The Humanitarian Award. You may find stories of recent award recipients on the FedEx Ground site.

Conclusion

Amazon and FedEx have evolved uniquely divergent models for the provision of package delivery services. The former involves a collection of small businesses with limited authority over their own operations, a great deal of company oversight and the inability to actually sell the business; while the latter entails the aggregation of many independent, for-profit corporations given great latitude to operate for their own risk and reward all while having the right to sell the business to a 3rd party.

The reasons that each company has developed such different delivery models is a moot point. However, it is worth mentioning that Amazon operates its delivery services at a net loss to the company, subsidizing them with its other diverse revenue streams. It is more important for them to enlist good soldiers rather than entrepreneurs. On the other hand, FedEx Ground’s sole focus of operations and revenue source is package delivery. Therefore, they benefit most from accessing the talents of ambitious entrepreneurs. The success of their operations relies on having independent business owners akin to four-star generals who can acquire and maximize the use of resources unique to their service area. The profitability of each independent business lends itself to the profitability of the corporation as a whole.

The decision to become a DSP or CSP hinges on the particular career goals of each individual. Black Iron Advisers specializes in assisting entrepreneurs to become FedEx CSPs or to expand current operations with FedEx Ground. Combining extensive investment banking expertise with firsthand FedEx CSP operator knowledge, they can help you identify appropriate business opportunities and complete such transactions to your maximum benefit. For more information, you may contact them here.